Aviva UK launches a new telematics initiative in collaboration with IMS

Read the full storyPowering successful mass market telematics programs for the world’s leading insurers and mobility providers

What we do

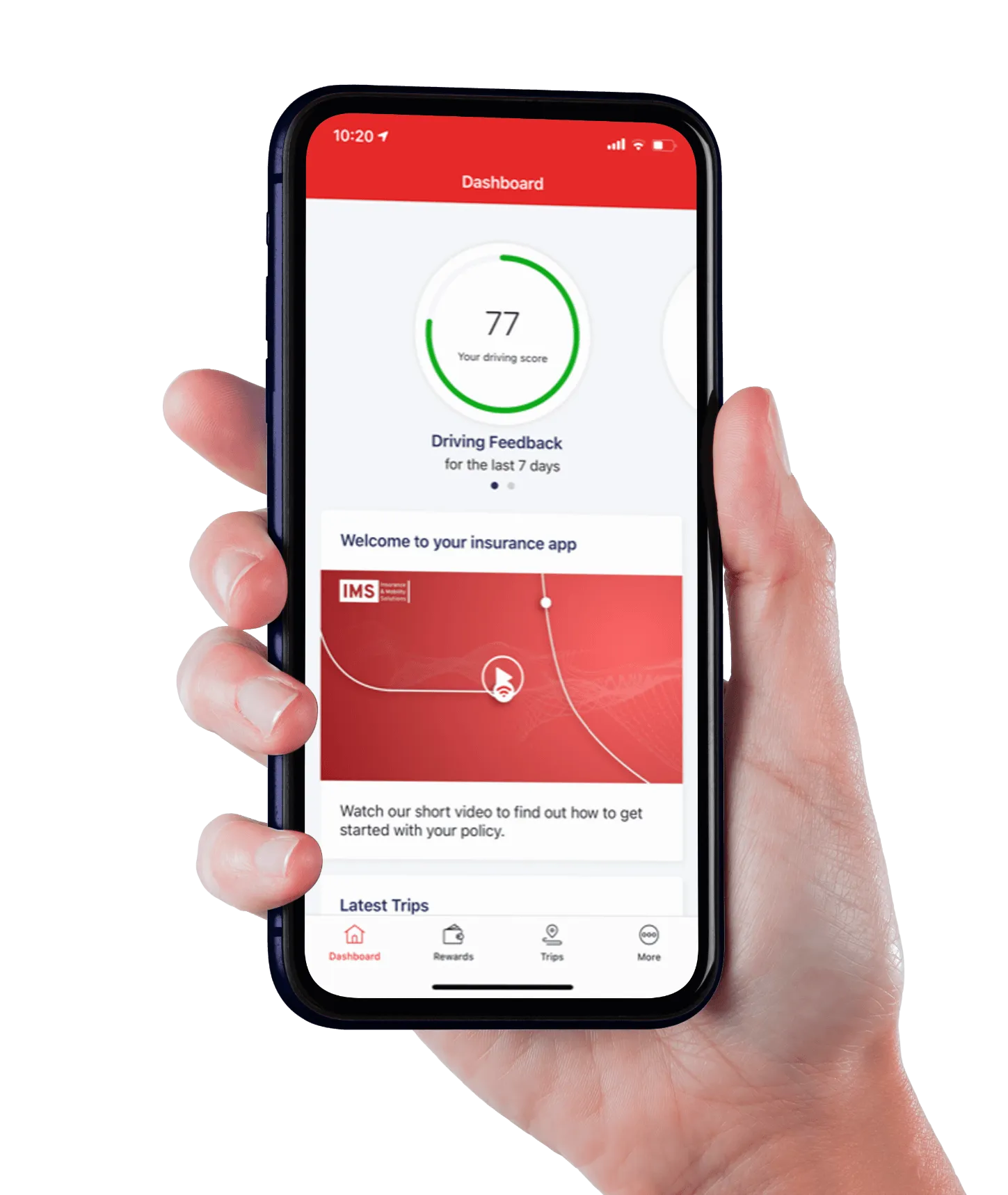

Configure your mobile experience for serious engagement, not just display.

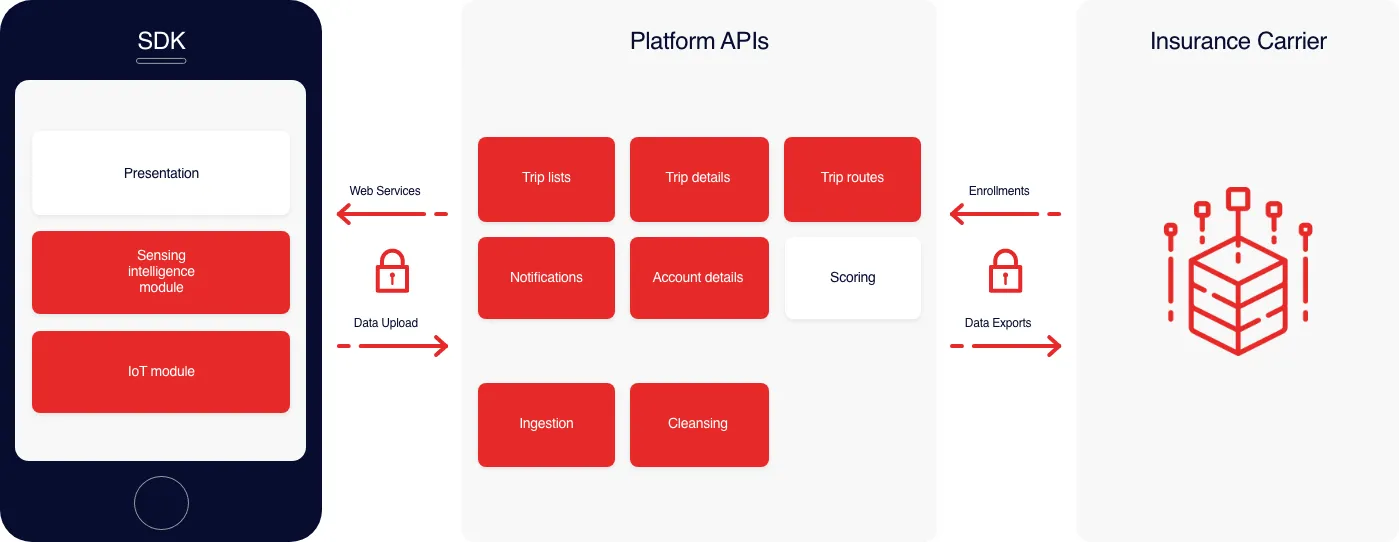

Access the mobile telematics you need to truly improve driving behavior. Configure a new mobile telematics app or leverage our SDK and deliver a unique, engaging, and personalized experience for your customer.

Already have a mobile app? Embed the risk-free IMS One App SDK into your existing solutions to boost accuracy, performance, and flexibility.

Improve journey capture and crash detection with the IMS Wedge™.

This BLE Beacon is a companion to IMS One App and designed to enhance trip data accuracy to improve program outcomes.

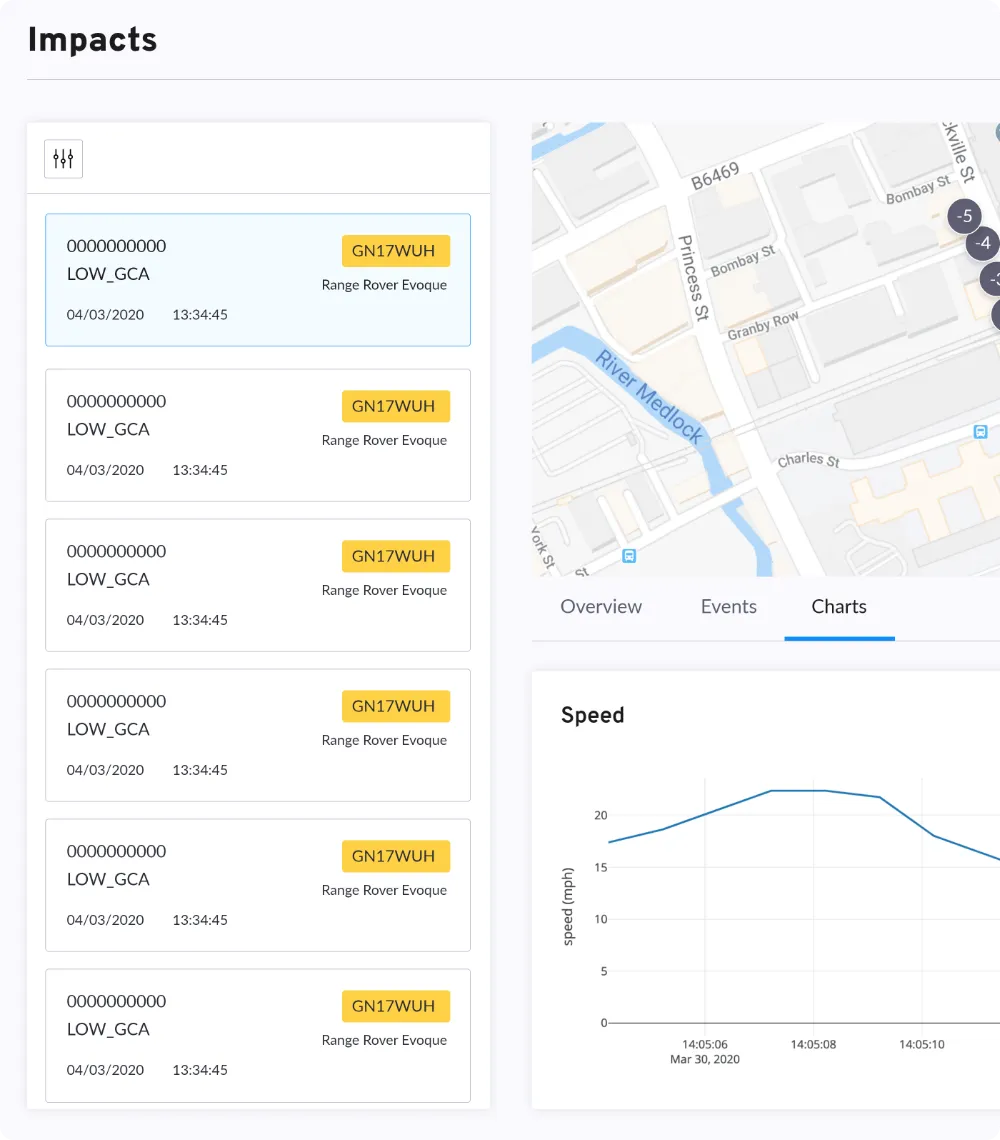

The industry’s first dedicated claims solution.

Unlock value from aFNOL and beyond, reducing claims costs through data-driven decision-making.

Educational whitepapers, webinars, industry news, and insight from our expert people

Testimonials

The IMS Engagement Toolset is the industry’s most comprehensive suite of engagement tools and techniques that leverages telematics data and is proven to modify driving behavior and drive desired business outcomes to drive down loss ratio values.

Learn more